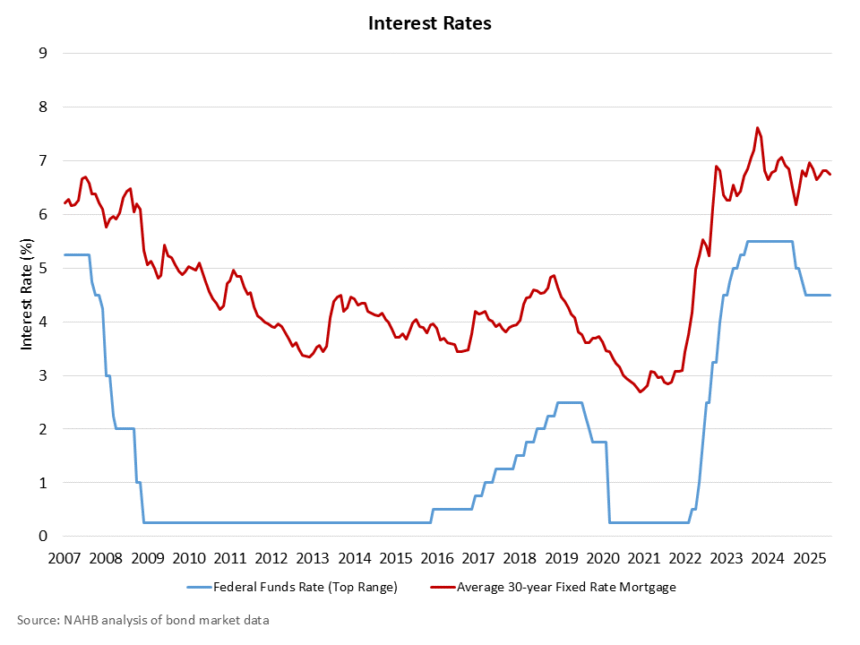

At the conclusion of its July meeting, the Federal Reserve’s monetary policy committee once again held the federal funds rate constant at a top rate of 4.5%. However, two members of the committee dissented from the decision (Fed Board Governors Waller and Bowman), the largest number of dissenting votes since 1993.

Moreover, some economic data – including a slowing housing market – are pointing to a need to resume normalizing the federal funds rate from its current, restrictive stance. In particular, Chair Powell noted in his press conference that the “housing market remains weak” and policy is “modestly restrictive.” NAHB is forecasting two rate reductions before the end of the year, including one at the next Fed meeting in September. President Trump has made it clear that he believes the central bank needs to cut again. All that said, except for the presence of dissenting votes in today’s decision, the Fed’s statement did not appear to be more dovish than those of prior months, which is indicative that the Fed remains data dependent.

While the Fed pointed to moderating growth, including a soft first quarter, “elevated uncertainty” about the outlook continues to be cited by the central bank. It is the case that evolving tariff policy, and trade negotiations in general, represent an uncertainty risk (although some, like Governor Waller, argue that tariff effects will represent a one-time effect on prices, not a source of ongoing inflation).

However, the combination of a quick move for cuts at the end of 2024 and the subsequent long, ongoing pause in 2025 is itself a source of uncertainty, particularly for businesses in sectors like residential construction whose financing costs are tied to short-term lending rates controlled by the Federal Reserve. The continued decline for service sector inflation points to moderating overall inflation, which when combined with softening job openings data and growing specifics about trade policy, provides justification for a resumption of continued monetary policy easing.

While a reduction in the federal funds rate would help the supply-side of the housing market via builder financing costs, long-term rates like mortgage interest rates are determined by investors and the bond market, not the Fed. So, while the economy would benefit from a resumption of monetary policy easing, impactful reductions for long-term interest rates depends on declines for inflation expectations, improvement of the government’s deficit outlook, and gains for productivity for the economy.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.