One of the risks of being prolific and public is the built-in assumption that readers are familiar with your body of work. We all occasionally engage in shorthand based on prior beliefs, discussions, and philosophy.

This turns out to be an error.

Anything one writes is across a continuum of prior ideas; the risk in any standalone piece is that it gets taken out of the context of the philosophy from which it comes.

To wit, “Tune out the noise.”

I was genuinely surprised by the pushback this piece received, particularly from a behavioral perspective, e.g., “nobody can just tune everything out.” My mistake was assuming that the advice I was giving would be interpreted via my broader writings, encouraging people to contextualize the noise appropriately. Not unreasonable, given this is throughout How Not to Invest” and all over “The Big Picture.” (See ten related chapters to these concepts here).

But alas, it was indeed misconstrued, and that is always on the author. I underestimated the impact of my headline; perhaps it primed readers towards the extreme message and away from contextualization (tho that was obviously not my intent).

Regardless, I want to clarify the idea of Tuning Out Managing the Noise. Let’s walk through five concepts needed to better frame this:

1. Information hygiene

2. Already in price?

3. Time Horizon

4. What is within your control?

5. Behavior

A few words on each concept:

1. Your information hygiene should be better than merely adequate: You should have a well-developed filter for screening out not just the most obvious nonsense, but much of the noisy, ephemeral silliness that is neither informative nor useful. Pay particular attention to emotionally resonant sources of opinion, speculation, and pontification. The social media stuff I grabbed (below) is classic algo-driven garbage.1

Beware the Non-experts (aka salespeople) who freely share their lack of expertise with the investing public.

2. Understand what is – and is not – already in prices: If it’s on TV, in the WSJ/NYT, on the radio, analyst opinions, on blogs, and/or Substacks, you can bet that this information is already reflected in stock prices. Markets may not be perfectly efficient, but they are kinda-eventually-sorta-mostly-efficient. If everybody else who has even a passing interest in the topic has seen the headline, heard the CEO, or read the 10Q, you can safely assume it’s already in the price.

Genuine surprises and new information, however, are not.

3. Activities around your portfolios should be in sync with your time horizon: It always seems surprising to have to say this, but: If you are saving for some future event 10 or 20 years off, what happens on any random Tuesday is irrelevant to your portfolio. Events like the 1987 crash, the September 11th terrorist attacks, the Flash crash, liberation day, and even the pandemic were quickly eclipsed by the broader economic and market trends.

For long-term investors, the most important thing is not to interfere with your portfolio’s ability to compound over time.

4. Recognize what is within your control: Most of the noisy information flow coming from your TV, radio, web browser, and social media is ephemeral, emotional issues that are wholly outside of your control. These include the war between Hamas and Israel which has since escalated to a hot conflict between Israel and Iran, the Russian invasion of Ukraine, the “No Kings” protests, the (amusing) crash in reputation, clients and staff of law firms which failed to understand their role in the broader legal system, the tariff trade, etc.

You have no insight into any of these issues, nor should you.

You have no insight into any of these issues, nor should you.

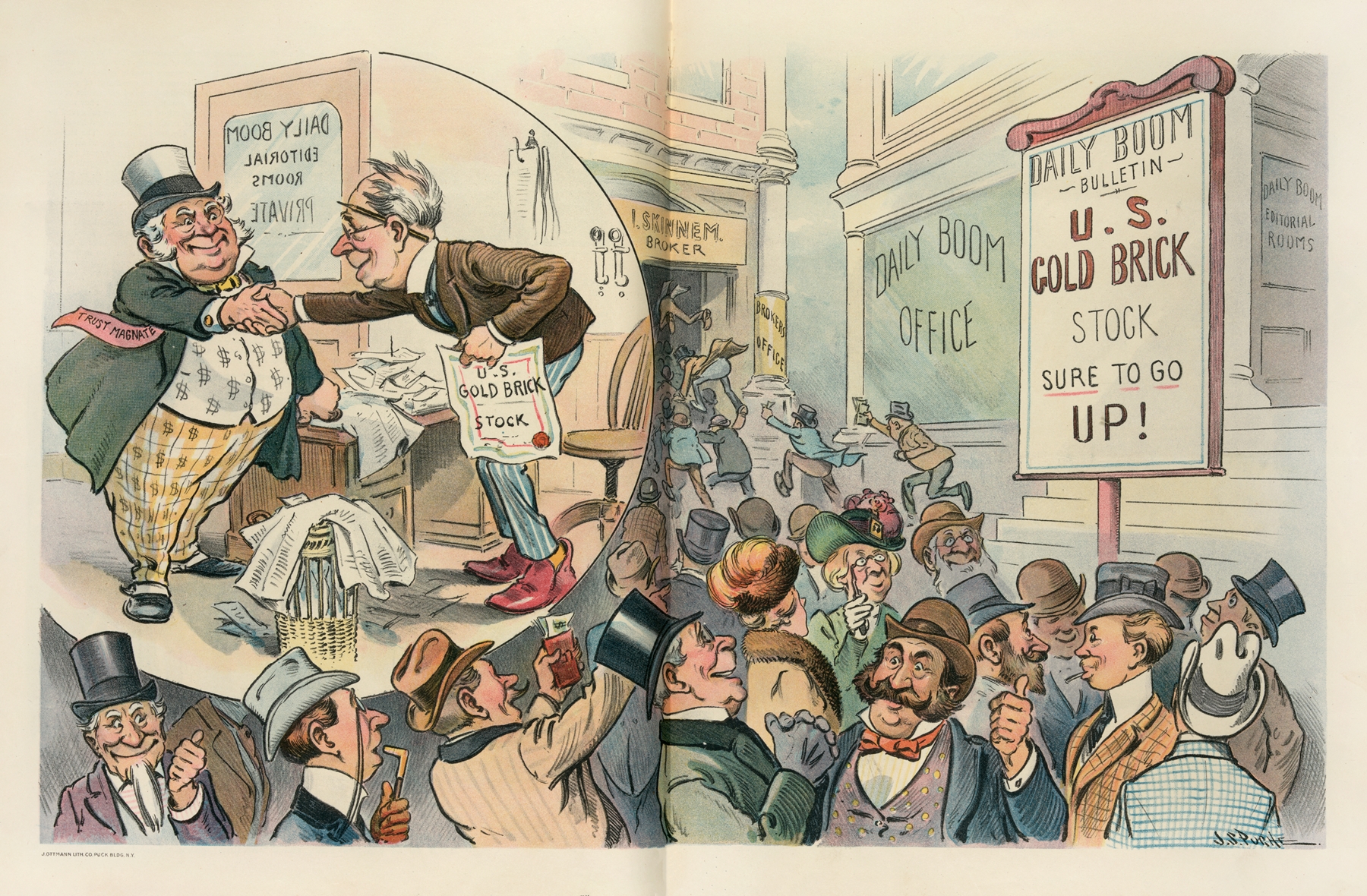

I’ve shown Batnick’s chart repeatedly but, “There’s always a reason to sell.” (see also the 2024 edition) The question is whether your limbic system will succumb to that temptation or not.

5. Manage your own behavior: the best for last, how you respond to this flow of information, the emotional triggers that could set you off, the variety of inputs that make it feel like “this time is different.” This is what determines your success or failure.

Paraphrasing Bill Bernstein, “Fail to manage your limbic system, and you will die poor.”

~~~

These five elements are what I consider canon for managing around the noise. You can architect your media diet, who and what you pay attention to, frame the news flow appropriately, and simply make better decisions.

Like so much else involved in investing, it is simple, but hard…

NOTE: I am changing the headline of the February 20, 2025 post from “Tune out the Noise” to “Tune out Manage the Noise.” 2

Previously:

Never Take Candy from Strangers (June 9, 2025)

Beliefs, Misconceptions & Behaviors (February 18, 2025)

Re-Engineer Your Media Diet (February 2, 2017)

Reduce the noise levels in your investment process (November 9, 2013)

More Signal, Less Noise (October 25, 2013)

The Price of Paying Attention (November 2012)

See also:

A Few Thoughts On the Selloff: Everybody Be Cool (Michael Batnick August 05, 2024)

Financial Advice That Doesn’t Work Anymore (May 9, 2025)

__________

1. There are a few of these bots and others that seem to be state sponsored propaganda — a mix of cut & paste headlines and total bullshit…

Source: X.com

Source: X.com

2. It’s worth repeating what I said in January and wrote in February:

“More importantly, pay attention to the broader context of where we are today. Back-to-back years of greater than 20% in equities strongly suggest we lower expectations for the following 12-24 months.”