Fees are going higher.

There has been a lot of coverage about this, especially with high-end credit cards like the Chase Sapphire Reserve and the Amex Platinum. Some of this is inflation, some business model adjustments, some just platform decay (aka enshittification).

Nobody really needs a points card, but if you use it well, it might be worth the cost.

I discussed a contrarian reason why pre-pandemic:

“Spending points provide any consumer with an opportunity to act as irrationally or even irresponsibly as they like, without the fear of negative consequences. (Spending recklessly on credit cards to accumulate points is idiotic; that is not what we are discussing here). I also am deeply aware of the advantages of purchasing experiences as opposed to the usual materialistic consumer stuff.

I see it not as a loss of 1%, an amount I do not imagine I was likely to have noticed either way. Instead, it is an unexpected windfall, providing an excuse to do some things and make some purchases you might not have done on your own, but wanted to.”

My choice is irrational. I intellectually understand that all cash is fungible, and that dollars back are both more flexible and more efficient than any points plan. I freely admit this. But it creates the opportunity to purchase guilt-free things I would not otherwise buy with my own money.

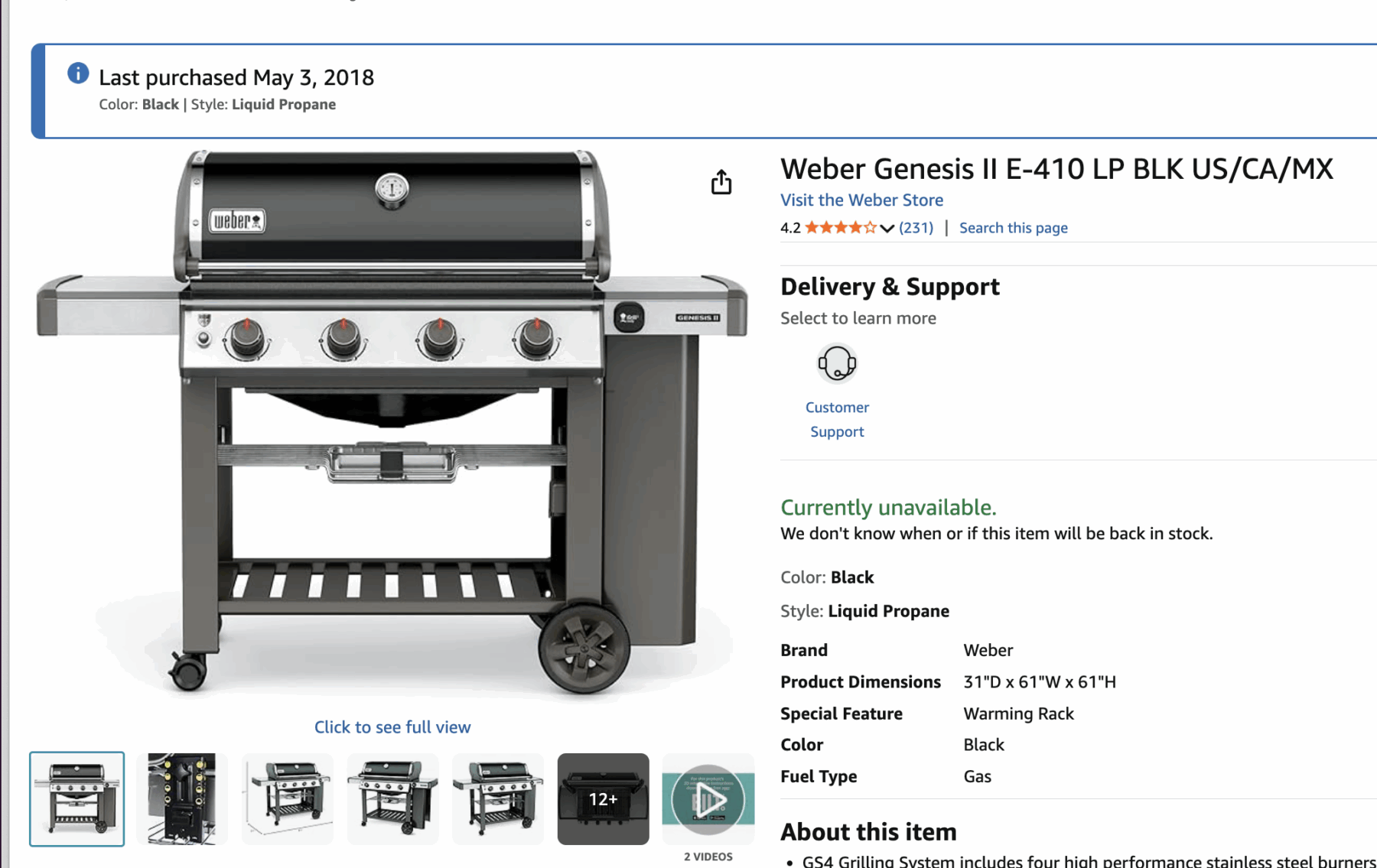

In 2018, I mentioned a ~$1000 Weber Grill (ironically, it reveals the impact of inflation that in 2018, that amount seemed silly for a grill). A $300 Dyson whisper fan for my desk that I would never have spent the money on; prior to that, an unusually generous points program at Restoration Hardware led to a new bedroom set.

Since then, I have purchased not one but two ridiculous Breville Espresso Machines with points: The Breville Barista Touch Impress Espresso Machine Brass Collection ($1700 at Williams Sonoma) and a Breville Oracle Touch Espresso Machine BES990BSS, Brushed Stainless Steel ($2500 at Amazon). Either of these machines purchased with real money would have ended in divorce, something you definitely cannot pay for with points.

The Math remains the same: Cash Back is rational, but Points can be used as an irrational behavioral hack…

Previously:

Adventures in Behavioral Finance, Points Edition (May 17, 2018)

See also:

How much in cash back/points makes a credit card worthwhile for you? (reddit)

The Problem With Rewards Credit Cards (The Atlantic, July 24, 2025)

Money anxiety is basically a part-time job now (Axios, Jul 30, 2025)