Sturgeon’s Law states, “90% of everything is crap.” 1

Theodore Sturgeon was a science fiction writer in the 1950s and 60s. He was frequently annoyed by critics who dismissed the genre based on its worst examples. When asked, “Why is so much science fiction so bad?” his answer became known as Sturgeon’s Law.

I have taken it upon myself to craft “Sturgeon’s Corollary,” which states the following:

“90% of all investment products are crap.”

The reason for this becomes clear across nearly every type of financial product: Mutual funds, SPACs, hedge funds, private investments, ETFs — you name it. The simple truth is that beating a broad benchmark net of fees and taxes over a long-term investment horizon (5 to 10 years +) is incredibly difficult. Add high(er) fees, investment strategies that fall in and out of favor, and human behavioral errors, and you have a formula that makes it difficult to beat a mostly indexed portfolio.

This is not to say that there aren’t excellent examples of all these products. There are some wonderful ETFs and a handful of outstanding mutual funds. Many hedge funds, especially those run by emerging managers, quants, and multi-strategy shops can and do generate alpha. However, we need to acknowledge that selecting the funds that will outperform in advance is a long shot. Only a rare few sustain outperformance over the long term.

Sturgeon’s Corollary is especially true in private markets. Private credit, private debt, and private equity have experienced tremendous growth over the past decade. This has resulted in a land grab, as many players rush into the space to secure assets and fees.

For UHNW investors and RIAs interested in this space, there are five areas they should focus on when considering adding alternative investments to their platform.

- Uncorrelated returns

- Risk

- Survivorship bias

- Illiquidity

- Costs

The most significant appeal of alternative investments is the claim of uncorrelated returns versus publicly traded equities and bonds. While one might assume that the underlying economic cycle will impact everything, there are instances where this has proven not to be the case. This is the most favorable aspect of private alternatives.

The second issue is risk, especially leverage. While we see many proposals showing better-than-index-based returns, many have achieved this Alpha through additional leverage. On a risk-adjusted returns basis, the outperformance often disappears.

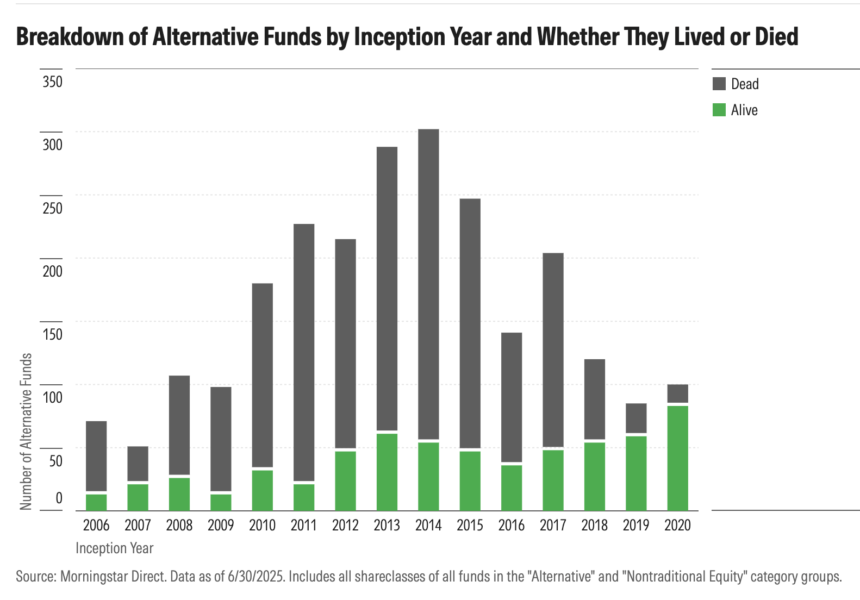

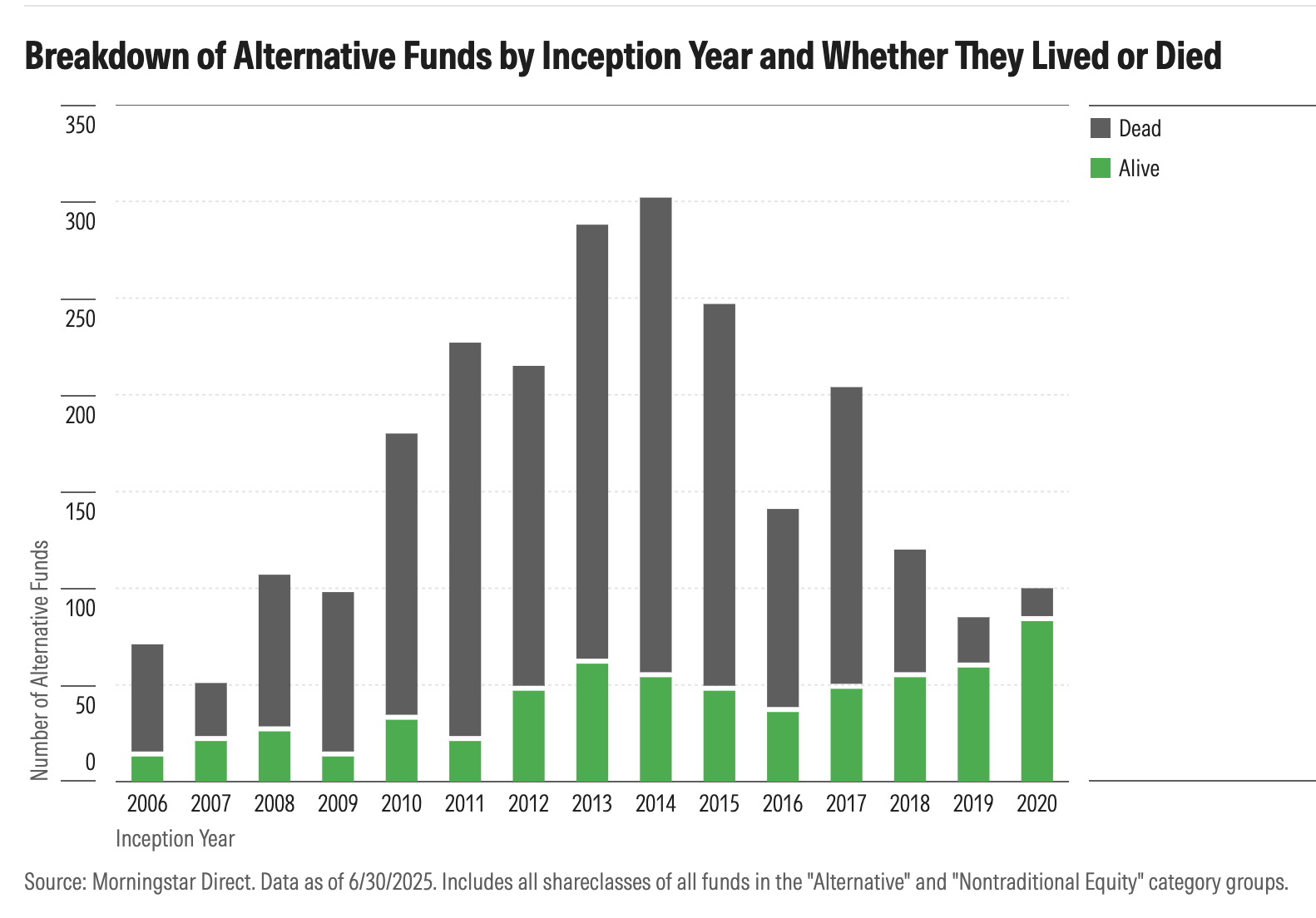

Illiquidity and costs are well understood, so let us consider survivorship bias. The most recent analysis of Jeffrey Ptak of Morningstar shows:

“On Jan. 1, 2015, there were 1,345 alternative mutual funds in existence. Only 341 still existed on June 30, 2025 – a 75% mortality rate.”

That is quite a stat: Three out of four funds folded across a decade, with most going belly up within the first five years. This creates a situation where the remaining fund performance across the entire asset class appears better historically than it is prospectively, because the typical fund that closes does so due to poor performance and an inability to attract capital.

My attitude toward private investments has evolved over the decades; I believe that if you can access the top decile of funds, you absolutely should. Opportunities to invest in the top quartile should also be considered. Anything below that should be approached skeptically, as they tend to be expensive, illiquid, risk-laden, and underperforming.

I expect this will be a challenging area for investors over the next decade. High-net-worth investors tend to hear about the best funds in the media while either ignoring or not learning about the rest of the field. As we have seen elsewhere, mutual funds, ETFs, hedge funds, SPACs, and so on, this is not a formula for success.

Your mileage may vary.

Previously:

10 Quotes That Shaped My Investment Philosophy (October 2, 2023)

Why Most SPACs Suck (October 26, 2020)

90% of Everything is Crap (July 25, 2013)

Sources:

75% of Alternative Mutual Funds Have Died. There Are Lessons in That for Would-Be Private Market Investors

Jeffrey Ptak,

Morningstar, Aug 11, 2025

The State of Semiliquid Funds 2025 (Morningstar 2025)

__________

1. See Effectiviology, which notes that Sturgeon formalized it further in the March 1958 issue of Venture, calling it “Sturgeon’s Revelation.”