I’ve never shared this story before, but since we are at a milestone, I might as well…

February 2000: I was working as a strategist for a brokerage firm. My buddy Anthony had an international clientele, all deeply invested in US tech companies. His biggest client was flying in from the Middle East for a combination New York City shopping trip/portfolio review.

His biggest position? Cisco (CSCO). Millions of shares worth 10s of millions of dollars…

I did not cover the company (I was not an analyst). But I had views on the networking and telecom sector; I believed everything in the “George Gilder Telecosm” was a disaster waiting to happen. Gilder’s (expensive) newsletter correctly identified budding technology trends, but also possessed awful timing. When his telecoms portfolio plummeted by about 90%, he had the nerve to actually say, “I don’t do price.” 1

But I digress.

Prepping for the meeting, I reached out to Paul Sagawa of Alliance Bernstein. In the 1990s, Sagawa was the axe on Cisco; for nearly two decades, he correctly identified the upside for the networking firm. But by 1999, Sagawa changed his tune. Cisco had become a giant market leader but was increasingly moving towards vendor financing. In the late 1980s, less than 5% of Cisco’s clients used the company’s own financing arm; a decade later, it was 90+%. “Buy our valuable cutting-edge technology, we only need your flimsy, VC-backed start-up to sign a promise to pay for it (eventually).”

Sagawa correctly saw this as a budding disaster.

The market isn’t kind to stock bulls when they reverse course and turn bearish.2 Throughout 1999, he went from a stock analyst superstar to a persona non grata. His fall from grace was vindicated twelve months later, but before the deluge, he was somewhat of an outcast.

My firm was not even a Bernstein client; I took a chance and called the number listed on his most recent CSCO research. To my surprise, he not only answered the call but also took the time to explain the situation to me for an hour. Sagawa provided the hard data and details for me to discuss the downside of Cisco with Anthony’s client, loaded with all the ammunition needed.

At the meeting, I started with the broadest overview: The stock was up ~3,700% since its IPO. The Sheik sat impassively as he took it all in. I drilled down into the details, the vendor financing, the changing technology landscape. I didn’t feel like I was making any headway, and didn’t want to badger him. The last thing I said was “You’ve made immense returns in this name, and we are years into this bull market; my best guess is there’s more downside risk than upside potential in the high-flying names – and Cisco is the poster child.”

I’m not a good salesman; I gave it my best shot, but didn’t expect much. I said my thanks and left.

I was surprised a few months later when Anthony came into my office with a little thank-you gift for the effort. “The sheik sold half, he is thrilled with us.” At the time, Cisco had already fallen 35% on its way to dropping ~90%.

I had written about the Fortune Cisco cover repeatedly – in 2000, then again years later. It’s now a cautionary chapter in How Not to Invest.

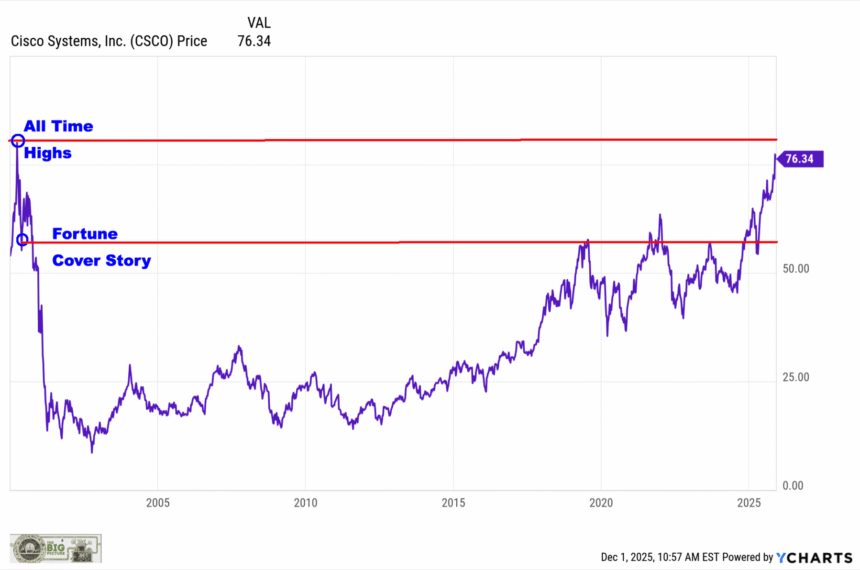

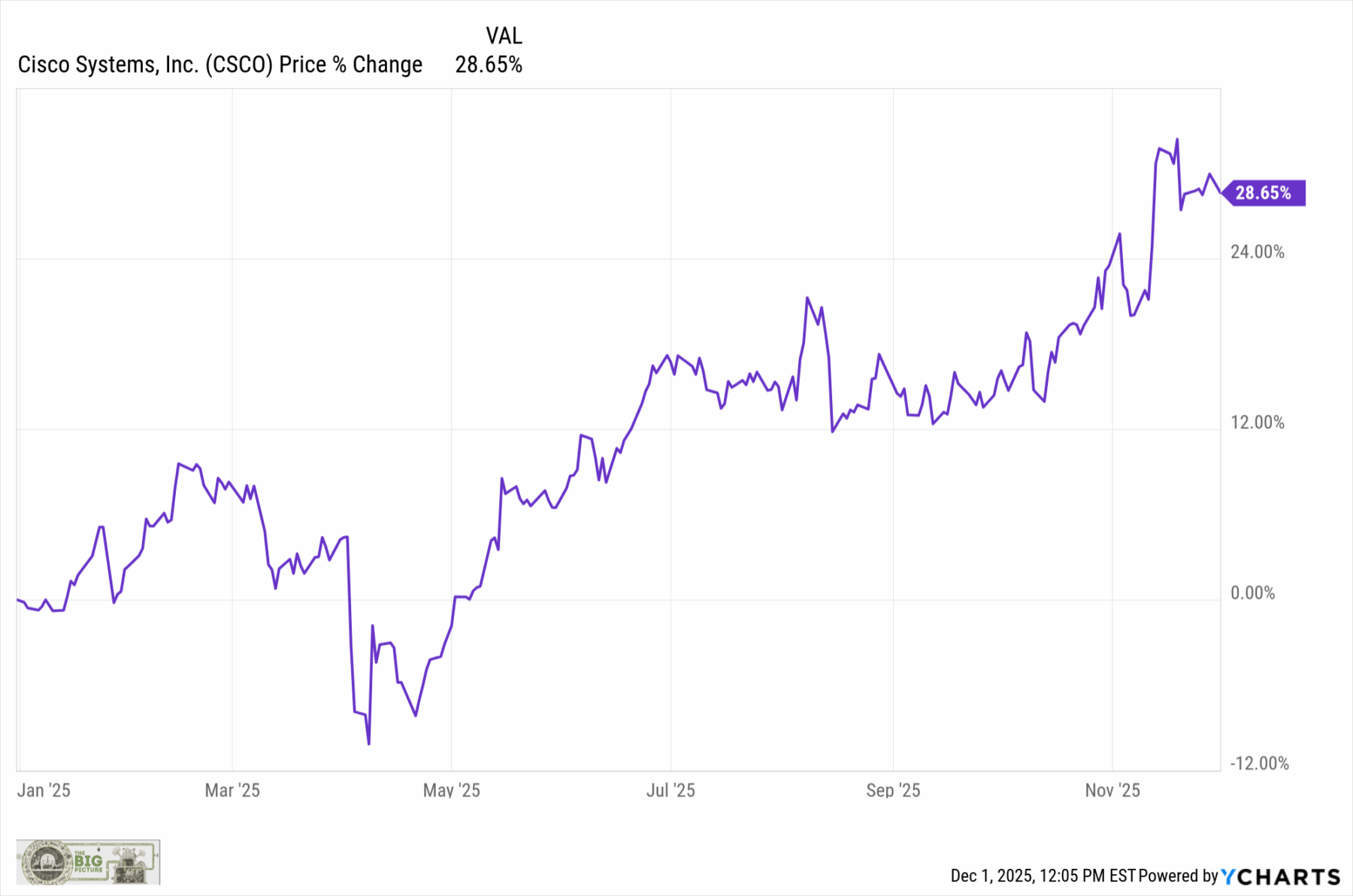

Here we are, 25 years later, and CSCO has perked up. Quantum computing, AI, and Cybersecurity have the stock rallying 28.9% this year. It has not quite reached $80.06, the dotcom peak in March 2000, but it is finally above the level where that infamous cover story (“No matter how you cut it, you’ve got to own Cisco”) came out.

The key lesson is that media coverage – of any stock, asset class, or investment – should never be a substitute for your own thinking.

Source:

There’s Something About Cisco

By Andy Serwer, Irene Gashurov, Angela Key

FORTUNE Magazine, May 15, 2000

Previously:

2000: “No matter how you cut it, you’ve got to own Cisco” (May 15, 2023)

Can Anyone Catch Nokia? (October 26, 2022)

Why the Apple Store Will Fail (May 20, 2021)

Nobody Knows Nuthin’ (May 5, 2016)

How News Looks When Its Old (October 29, 2021)

__________

1. “Most of the companies listed have lost at least 90 percent of their value over the past two years, if they’re even in business anymore.” –Wired

2. I experienced this firsthand with EMC…

~~~

I discuss the trouble with the CSCO cover in How Not to Invest: The ideas, numbers, and behaviors that destroy wealth―and how to avoid them.”

Its on sale at Amazon Cyber Monday Deal: $18.01